Investment Analysis Report -Seplat Energy

Francis Kyei, Senior Market Analyst

- Seplat Energy Plc has shown resilience over the past five years despite the COVID-19 pandemic and other internal challenges which affected its production targets. The company has a total asset of over US$3.1 billion (as of Q3, 2022)

- The company is rated B by Fitch with a stable outlook, B2 by Moody’s with a stable outlook, and B by S&P Global Ratings also with a stable outlook.

- The 2023 outlook for the petroleum industry by oil analysts presents a good opportunity for the company to make significant gains in 2023. Oil analysts predict oil prices can hit a record high in 2023.

Introduction

In the wake of the current volatility in the SSA sovereign Eurobond Market, we have evaluated the performance of Seplat Energy Plc, a hydrocarbon production company based in Nigeria, to determine whether the company’s bond on the international capital market presents an attractive alternative.

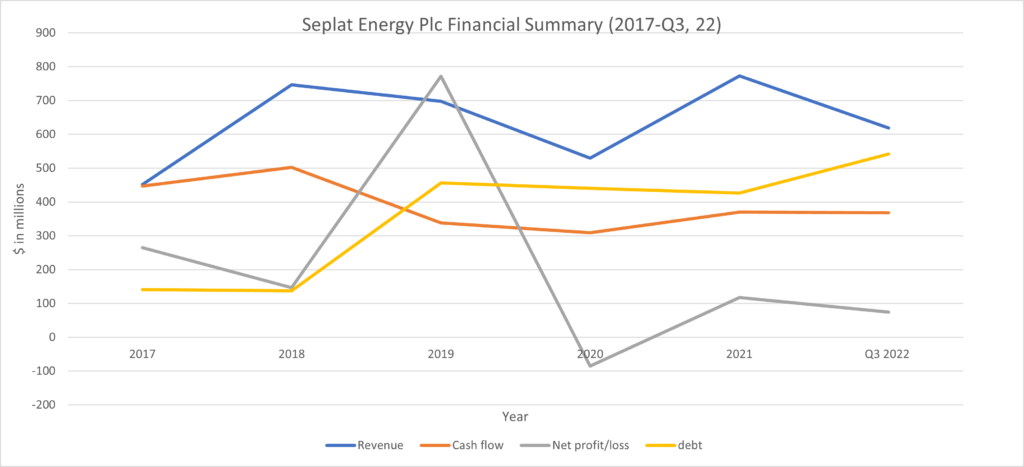

We have analysed the company’s financial performance between 2017 and Q3, 2022, as well as the global petroleum outlook for 2023, and have identified the micro and macroeconomic factors that present opportunities or pose threats to the company.

Seplat Energy Plc has a track record of maximising value from its upstream oil and gas assets. The company also provides 30% of processed gas for use for electricity in Nigeria. In 2019, Seplat became the first Nigerian company to acquire a UK-listed peer, Eland Oil & Gas Limited, to strengthen its portfolio.

Seplat Energy has a US$650 million corporate bond on the London Stock Exchange with a maturity date of April 1, 2026, and a 7.75% coupon rate.

Petroleum Sector Outlook 2023

Global inflation is expected to be one of the main drivers of crude oil prices in 2023. Although inflation is expected to decline to 6.5% in 2023 from 8.8% the year before (according to the IMF), general price increases will continue to have an impact on crude oil prices.

In addition, demand for crude oil is expected to increase this year due to economic activity in China picking up faster than anticipated following the removal of COVID-19 restrictions in the country.

The forecast for China’s economic growth for 2023 by Fitch Rating Agency has been revised from 4.1% to 5.0%

According to Fitch, the new forecast reflects evidence that consumption and economic activity are recovering faster than initially anticipated after the Chinese authorities moved away from its “Zero Covid-19” policy stance.

Demand for oil in the world’s most populous country is expected to put pressure on the prices of crude oil in 2023.

Some analysts also predict that the expectation of a global recession in 2023 will reduce the pressure on oil prices. However, the reopening of the Chinese economy, high global inflation, and the tight supply stance of OPEC will have a much bigger impact on oil prices.

ING Group forecasts a combination of lower Russian oil supply and OPEC’s supply cuts to tighten the global oil market in 2023. ING expects a growing deficit over the course of the year, which suggests that oil prices should trade higher.

The global petroleum sector generated an estimated $5 trillion in global revenue in 2022 due to high oil prices fuelled mainly by geopolitical factors. In 2023, global oil demand is set to rise by 1.9 mb/d in 2023, to a record 101.7 mb/d, with nearly half the gain from China. Jet fuel remains the largest source of growth.

On the supply side, the International Energy Agency (IEA) expects global oil supply to slow by 1 mb/d in 2023 following last year’s OPEC-led growth of 4.7 mb/d. The Energy Information Administration (EIA) in the United States (US) also forecasts global oil production for the year to average 100.7 million b/d.

Financial Statement and Balance Sheet (2017-Q3 2022)

2017: The company’s financial performance in 2017 was on the account of oil prices trading at an average of US$50/bbl. Seplat Energy recorded a revenue of US$452 million and a cash flow of US$447 million. The company navigated through the economic challenges in Nigeria that year, a weak currency, and militant attacks on key oil infrastructure in the Niger Delta, and still recorded a profit of US$265 million. The company’s debt at the end of the year was US$141 million. However, total assets amounted to US$2.6 billion, including cash assets of US$437 million.

2018: Seplat Energy recorded robust profitability and cash flow which provided a strong foundation for growth. The company increased its revenue to US$746 million and a cash flow of US$147 million. Seplat recorded a profit of US$147 million and reduced its debt to US$137 million. Seplat Energy’s cash asset was US$584 million, and its total assets were US$2.5 billion.

2019: The company’s operational and financial performance reflected lower overall production levels and a weak oil price environment. Seplat energy recorded a post-tax profit of US$277 million while cash generated from operations of US$338 million remained comfortably in excess of capital investments which amounted to US$125 million in the year. The company maintained a robust balance sheet in 2019, ending the year with US$333 million cash at the bank and a net debt position of US$456 million. The total asset was US$3.2 billion

2020: The year was full of challenge and change, not just for Seplat but for the entire global economy. The Covid-19 pandemic spread quickly across the world, and was an unprecedented shock to the global economy, with a consequent impact on the demand for oil and gas. The economic shock was reflected in the lower demand for oil. Seplat Energy’s revenue dropped to US$530 million, cash flow recorded US$309 million, and a debt of US$440 million. The company recorded a loss of US$85 million. On its balance sheet, Seplat Energy had a cash balance of US$258 million and total assets worth US$ 3.4 billion

2021: The global economy was gradually bouncing back from the COVID-19 pandemic and recorded a growth of 5.9% while the Nigerian economy grew by 3.4% (World Bank). The global energy sector recorded an unexpectedly fast pace of recovery, leading to unprecedented demand-growth for energy, which challenged the supply side. Seplat Energy recorded a revenue of US$773 million and a cash flow and net profits of US$370 million and US$177 million respectively. The company’s debt stood at US$426 million. Seplat Energy’s cash asset for the year was US$183 million and total assets of US$3.5 billion

Q3, 2022: – The company recorded a revenue of $619 million as 44.8% oil price gains were able to more than offset the fall in its oil production, flat gas production, and the slight fall in average gas prices. Seplat recorded a cash flow of US$368 million and a profit of US$74 million. The company’s total debt at the end of the nine months was US$542 million. On the company’s balance sheet, cash asset for the period was US$324 million and total asset was US$3.1 billion

Conclusion

Seplat Energy Plc is yet to release the full 2022 financial report; however, there are clear signs that the company will post an impressive end-year performance and a strong balance sheet.

The company has a B rating from Fitch with a stable outlook, B2 from Moody’s with a stable outlook, and B from S&P Global Ratings also with a stable outlook. This indicates that the company’s creditworthiness is better than many sovereign and corporate Eurobonds on the market.

Additionally, the impressive 2023 outlook for the petroleum industry by oil analysts presents a good opportunity for the company to make significant gains in 2023. Oil analysts predict oil to hit a record high in 2023; however, concerns over climate change mean Seplat needs to be more innovative to keep production going while minimizing carbon emissions.

The company has shown resilience over the past five years despite the COVID-19 pandemic and other internal challenges which affected production targets. Seplat Energy’s portfolio comprises seven oil and gas blocks in the Niger Delta, which it operates with partners including the Nigerian Government and other oil producers, as well as a revenue interest in OML 55.

Seplat Energy is in a strong position to service its coupon payments on its bond, considering its credit ratings, cash assets, and balance sheet. Currently trading at around $0.81 Seplat 26 Eurobond is a good investment option.

Disclaimer: This article has been prepared by GFX-Prime, an African investment firm with its registered office on the 2nd Floor, PWC Towers, Cantonments City, Accra Ghana. This article has been issued for information purposes only. GFX-Prime does not recommend or propose that the securities referred to in this article are appropriate or suitable for your investment objectives or financial needs

subscribe to receive current ssa market and investment analysis directly from our trading desk

Ghana Navigates Tightrope in Eurobond Debt Restructuring

Francis Kyei, Senior Market Analyst, Ghana, constrained by previous creditor agreements, faces critical negotiations with Eurobond holders as it seeks major cuts. The country aims for substantial concessions from bondholders, amidst concerns of a potential standoff similar to Zambia’s recent experience. Ghana is embroiled in a challenging negotiation with its Eurobond holders, with a limited range of options at its disposal, a confidential…

IMF Approves Crucial $684.7 Million Loan to Kenya Amidst Fiscal

Francis Kyei, Senior Market Analyst, IMF disburses $684.7 million to Kenya, part of a larger $941 million package, tosupport fiscal stability and impending Eurobond repayment. Financial aid to ease liquidity challenges and bolster foreign-exchange reserves amidrising external debt maturities and weakening currency The International Monetary Fund (IMF) has approved a significant financial boost for Kenya, with an immediate disbursement of $684 million, as…

Ghana Achieves Four-Year Interest Freeze in Bilateral Debt Agreement with

Francis Kyei, Senior Market Analyst Official Creditor Committee agrees to a 4-year debt suspension, 2-3% interest from the fifth year of Ghana’s loan repayment, with room for further negotiations. IMF Executive Board to review Ghana’s programme this Friday, after bilateral debt restructuring agreement. The agreement is set to provide Ghana with immediate financing of approximately US$1.15 billion. The Executive Board of the International Monetary…

Ghana Receives Debt-Relief Terms; IMF Optimistic About $600M Disbursement

Francis Kyei, Senior Market Analyst Ghana has secured debt-relief terms from its bilateral creditors, resulting in a positive outlook from the IMF for a second tranche of $600 million. The IMF is optimistic for Ghana’s negotiations with its creditors, yet there is rising criticism surrounding the IMF agreement. The success of the restructuring process is vital for achieving a debt-to-GDP ratio of 55%…

Ecobank Transnational Inc (Investment Analysis)

Francis Kyei, Senior Market Analyst Introduction This report provides an overview of Ecobank Transnational Incorporated’s (ETI) financial performance for the first nine months of 2023, highlighting key strengths and areas of concern. It provides insights into the bank’s ability to generate revenue, maintain financial stability, and navigate challenges. The analysis covers key financial metrics, comparative performance with peers (UBA, Fidelity, and FBNH), credit…

Ghana Explores Green Bonds for Climate-Resilient Projects

The Ghanaian government, inspired by Zambia’s renewable energy funding, is considering green bonds to finance climate-resilient projects. Ghana is actively developing projects to produce and export carbon credits, with a Carbon Market office established to manage sales. Aiming for $50 million in carbon revenue by 2024, Ghana plans to reduce over 64 million tons of CO2 equivalent by 2030, supported by global…