Investment Analysis Report: ACCESS BANK PLC.

Introduction

This report is an analysis of the fundamentals of Access Bank Plc. We have assessed the company’s financial performance from 2019 to September 30, 2022, its credit ratings, and have drawn a conclusion on whether the company’s bonds on the market offer attractive options to investors seeking to make gains in 2023.

We have investigated the financial soundness of Access Bank Plc. and prospects to determine whether the company’s Access Perp and Access 2026 bonds make satisfactory investment. The report also considers the broader global and continental outlook of the financial industry. Access Bank is a full-service commercial bank operating through a network of more than 700 branches and service outlets spanning 3 continents, 17 markets and 52 million customers.

With 28,000 employees, the bank operates in Nigeria and has subsidiaries in several countries in sub-Saharan Africa, the United Kingdom, Dubai, UAE and representative offices in China, Lebanon and India. The company serves its various markets through four business segments: Retail, Business,

Commercial and Corporate.

The Bank has over 900,000 shareholders (including international and institutional Investors) and has enjoyed a successful banking growth trajectory in the last twelve years. Following its merger with Diamond Bank in March 2019, Access Bank became one of Africa’s largest retail banks by retail customer base

2023 Global Economic Outlook

The global economy is on a broad-based slowdown, with inflation soaring to multi-decades high. Central banks have responded with monetary policy tightening to ensure price stability. Many emerging economies are facing deep fiscal difficulties (IMF’s World Economic Outlook, October 2022 edition)

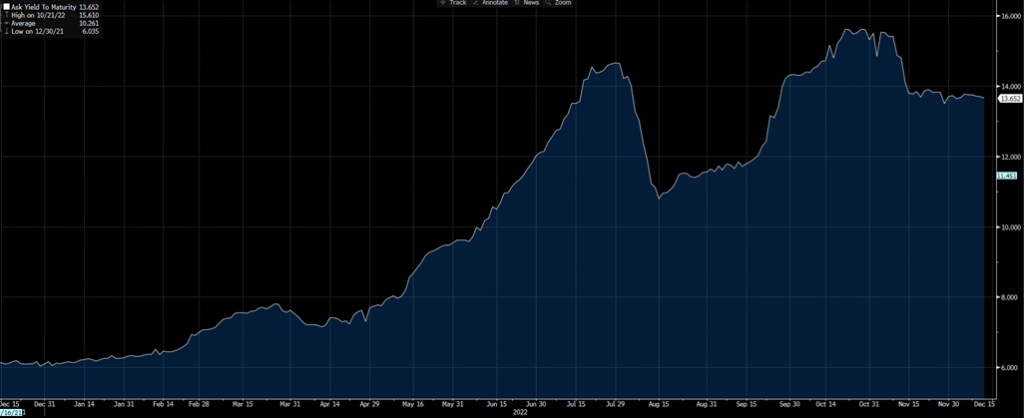

Russia’s invasion of Ukraine and China’s zero-COVID-19 strategy to restrict mobility have also pulled down global economic activity. In sub-Saharan Africa, bond yield spread for more than two-thirds of sovereign bonds breached the 700-basis point level in August 2022-significantly more than a year ago, according to the IMF.

A common theme facing emerging market bond investors is the challenging backdrop created by a strong US dollar and higher USD rates. Next year should bring similar challenges, as some emerging markets are faced with weak currencies already. Lower dollar reserves, with less headroom to counteract any further dollar-imported inflation, and limited fiscal leeway are also likely to pose a risk (Barclays Outlook 2023: A Rebalancing Act)

Barclays predicts 2023 to be a turning point for emerging markets. According to the bank, emerging markets can stage a comeback if the US policy rates peak, and if the market starts to lower rates for 2024 or 2025. The timing may coincide with higher bond spreads, which would open opportunities.

S&P Global Ratings also predicts 2023 to be a tough year for emerging markets due to tightening financial conditions, a strong US dollar, slower growth in China and the potential recession in the US and Europe. However, banks with strong balance sheets can buffer headwinds, with solid capitalization and sound asset quality (S&P Global Bank Outlook 2023)

With no major African economy expected to enter a recession, combined with major African banks showing a good degree of resilience over the past two years, Fitch believes there will be no substantial downside scenario in Africa’s financial sector (Fitch’s African Banks Outlook 2023)

Access Bank Plc’s Financial Summary (2019 to end September 2022

Access Bank Plc posted a profit before tax of ₦147 billion (approx. US$330 million) at end September 2022 against ₦135 billion (approx. US$303 million) recorded in September 2021. The company recorded a profit before tax of ₦112 billion (approx. US$251 million) and ₦126 billion (approx. US$ 282 million) in 2019 and 2020 respectively.

Profit after tax increased from ₦94 billion (approx. US$210 million) in 2019 to ₦106 billion (approx. US$237 million) in 2020. The company further increased its profit after tax to ₦122 billion (approx. US$273 million) in 2021 and ₦137 billion (US$307) in 2022.

The total assets of Access Bank Plc increased from ₦7.1 trillion (approx. US$16 billion) in 2019 to ₦8.6 trillion (approx. US$19 billion) in 2020.

Notwithstanding the ravages of the COVID-19, Russia-Ukraine war, among other global challenges, Access Plc further increased its total assets from ₦11.7 trillion (approx. US$26.3 billion) in 2021 to ₦13.4 trillion (approx. US$31.1 billion) at end September 2022.

Note: All currencies were converted from the naira to the USD. The conversion was made based on the naira/USD rates on Monday

December 12, 2022 (US$1 to ₦444.18)

Access Bank Plc Credit Ratings

Access Bank Plc’s Credit Ratings and Viability Ratings by Fitch have been constant at B and B-since 2019. In the November 2022 rating, Access Bank Plc was rated B- in both Credit and Viability Ratings. Fitch assigned the ratings considering the bank’s standalone profiles and potential support.

S&P Global Ratings in June 2022 affirmed its ‘B-/B’ long- and short-term global scale issuer credit ratings on Access Bank PLC with a stable outlook.

According to S&P, Access Bank benefits from its market-leading position in Nigeria and diversified business model. It is the largest banking group by assets in Nigeria, with a large retail franchise and well-established corporate business.

Future of Access Bank

The Management of Access Bank is positioning the company to maximize opportunities in Africa on the back of a growing customer base and the move to a cashless economy.

The company believes Africa holds a vast pool of opportunities with over 370 million unbanked adults, US$9.2bn in remittances and cross border payments, 89 cities of over 1.3 billion inhabitants by 2025 and the overall African financial ecosystem.

The company sees opportunities coming from the new African Continental Free Trade Area (AfCFTA), as it is expected to expand intra-Africa trade, eliminate tariff on qualifying trade and increase financial flows.

In addition, Nigeria presents several opportunities for the bank due to its large population, huge payments, remittance flows, and an emerging insurance market. To capture these opportunities, Access Bank is transitioning into 4 subsidiaries to tap into the market opportunities that are available in the regulated banking and consumer lending market, electronic payment industry and retail insurance market.

Through this reorganization, Access Bank hopes to create new product revenues, ensure diversification of earnings, and expand beyond the region.

In June 2022, Access Bank Plc announced that it has entered into a binding agreement with Kenyan-based Centum Investment Plc (‘Centum’) For the entire 83.4% equity stake held by Centum in Sidian Bank Ltd (‘Sidian’).

The Purchase consideration is approximately up to US$ 37 million. Sidian will be merged with Access Bank’s subsidiary in Kenya, Access Bank Kenya, to create a stronger banking institution better positioned to serve the Kenyan market.

Conclusion

Access Bank benefits from its market-leading position in Nigeria and diversified business model. It is the largest banking group by assets in Nigeria, with a large retail franchise and well-established corporate business.

Following the acquisition of Diamond Bank in 2019, the group’s digital strategy, combined with its agency banking, has led to significant growth in the retail franchise.

S&P believes the recently expanded geographic diversification, which largely focuses on retail transactional banking, payments, cash management, and trade finance, will continue to support revenue stability and earnings capacity of the bank. The addition of new businesses, such as payment and switching services and the insurance brokerage under the holding company structure, will also aid in strengthening noninterest revenue.

The international rating agency expects capitalization and asset quality of Access Bank to remain stable in 2022. S&P also expects nonperforming loans to reduce to less than 4% of gross loans, below the 5% regulatory limit, reflecting write-offs and recoveries on the acquired books, economic recovery, and higher oil prices.

We believe the financial position of Access Bank Plc and prospects for the future make the company’s bonds attractive. The risk of default on its semi-annual coupon payments of 13.4% and 19.16% on the Access 2026 and Access Perp Bonds respectively are very low. Investors can consider these bonds to make their portfolios defensive against the uncertainties in 2023.

By Francis Kyei, Senior Market Analyst, GFX-Prime Email: francis.kyei@gfxprime.com + 233(0)596920995

GFX-Prime is a securities trading company headquartered in Accra, Ghana. We provide wholesale market participants with prime liquidity services to assess trading availability and successfully execute Sub-Saharan African credit and African FX

Disclaimer: This article has been prepared by GFX-Prime, an African investment firm with its registered office at the 2nd Floor, PWC Towers, Cantonments City, Accra Ghana. This article has been issued for information purposes only. GFX-Prime does not recommend or propose that the securities referred to in this article are appropriate or suitable for your

investment objectives or financial needs