China can’t hold Ghana’s debt restructuring to ransom

Francis Kyei, Senior Market Analyst

- Unlike Zambia and Sri Lanka, Ghana seems to be making headway in its debt restructuring efforts, and the US$1.7 billion debt to China may not even be a hurdle.

- Although discussions between the two countries are steadily progressing, Ghana is ready to go ahead with its debt restructuring programme if negotiation fails.

- Ghana is confident of a board-level IMF deal by April 2023.

Despite fears that Ghana’s external debt restructuring negotiations may delay considering how similar talks between Zambia and Sri Lanka have dragged on, the West African country seems to be making significant progress.

A government source with direct knowledge about Ghana’s debt restructuring talks has disclosed that the country has had fruitful discussions with its external creditors and is set to secure a board-level IMF deal latest by April this year.

According to the source, the negotiations over Ghana’s US$1.7 billion debt to China cannot delay the debt restructuring process as has been the case with Zambia and Sri Lanka.

Chinese lending to Zambia constitutes about 40% of the country’s total external debt while Sri Lanka’s US$7 billion debt to China accounts for about a fifth of the country’s total debt. However, Ghana’s debt to China is less than 5% of the country’s total debt of US$47 billion.

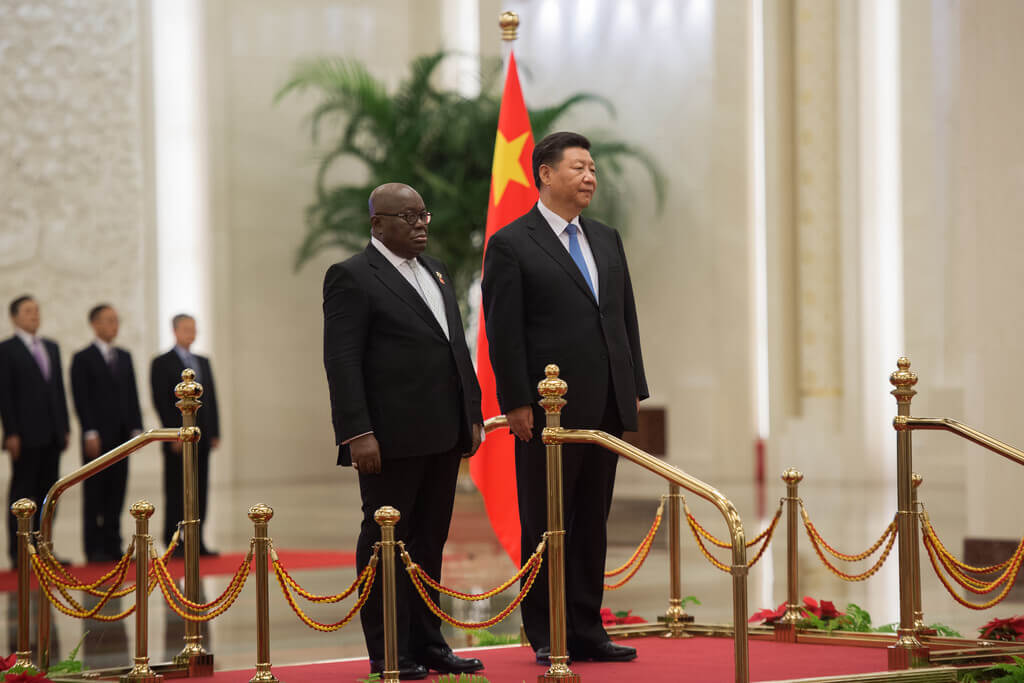

Ghana-China debt talks.

Ghana’s debt to China is a bauxite-for-infrastructure barter arrangement with China’s Sino-hydro Corporation.

The country took a US$2 billion facility from the Chinese state corporation in 2018 for infrastructural development with the aim of paying back with alumina processed from the country’s bauxite deposits.

Ghana has classified the facility under its external debts and intends to renegotiate the terms as part of the debt exchange programme.

However, the country is yet to convince China to agree to its demands, the source said and added that the negotiations have been fruitful but have not yet concluded.

“China is still making some demands which may be legitimate but if the negotiations do not go through, we can still go ahead with our debt restructuring.”

“Since the initial arrangement is a barter, Ghana can still go ahead with its debt restructuring programme. China cannot hold us in ransom like Sri Lanka and Zambia”.

The Ghanaian government believes the restructuring of the Sino-hydro deal can help reduce the country’s debt-to-GDP ratio to 55% from the current levels (over 100%)

On discussions with the Paris Club, the source said the group recognised the difficult position Ghana finds itself in and is ready to support Ghana’s debt restructuring efforts.

Negotiations with Eurobond holders

The source said Ghana has successfully made a strong case to the Eurobond holders in informal discussions.

“We have got some assurances that they will support us,” the source said, but could not point out how much cuts Eurobond holders will suffer.

“We are trying to build scenarios. Once that is done, we can firmly announce the levels. But at the moment, we have firm assurances from our creditors and we are on course to secure the IMF deal very soon,” the source said.

Disclaimer: This article has been prepared by GFX Prime, an African investment firm with its registered office on the 2nd Floor, PWC Towers, Cantonments City, Accra Ghana. This article has been issued for information purposes only. GFX Prime does not recommend or propose that any security referred to in this article is appropriate or suitable for your investment objectives or financial needs.

subscribe to receive current ssa market and investment analysis directly from our trading desk

Ghana Navigates Tightrope in Eurobond Debt Restructuring

Francis Kyei, Senior Market Analyst, Ghana, constrained by previous creditor agreements, faces critical negotiations with Eurobond holders as it seeks major cuts. The country aims for substantial concessions from bondholders, amidst concerns of a potential standoff similar to Zambia’s recent experience. Ghana is embroiled in a challenging negotiation with its Eurobond holders, with a limited range of options at its disposal, a confidential…

IMF Approves Crucial $684.7 Million Loan to Kenya Amidst Fiscal

Francis Kyei, Senior Market Analyst, IMF disburses $684.7 million to Kenya, part of a larger $941 million package, tosupport fiscal stability and impending Eurobond repayment. Financial aid to ease liquidity challenges and bolster foreign-exchange reserves amidrising external debt maturities and weakening currency The International Monetary Fund (IMF) has approved a significant financial boost for Kenya, with an immediate disbursement of $684 million, as…

Ghana Achieves Four-Year Interest Freeze in Bilateral Debt Agreement with

Francis Kyei, Senior Market Analyst Official Creditor Committee agrees to a 4-year debt suspension, 2-3% interest from the fifth year of Ghana’s loan repayment, with room for further negotiations. IMF Executive Board to review Ghana’s programme this Friday, after bilateral debt restructuring agreement. The agreement is set to provide Ghana with immediate financing of approximately US$1.15 billion. The Executive Board of the International Monetary…

Ghana Receives Debt-Relief Terms; IMF Optimistic About $600M Disbursement

Francis Kyei, Senior Market Analyst Ghana has secured debt-relief terms from its bilateral creditors, resulting in a positive outlook from the IMF for a second tranche of $600 million. The IMF is optimistic for Ghana’s negotiations with its creditors, yet there is rising criticism surrounding the IMF agreement. The success of the restructuring process is vital for achieving a debt-to-GDP ratio of 55%…

Ecobank Transnational Inc (Investment Analysis)

Francis Kyei, Senior Market Analyst Introduction This report provides an overview of Ecobank Transnational Incorporated’s (ETI) financial performance for the first nine months of 2023, highlighting key strengths and areas of concern. It provides insights into the bank’s ability to generate revenue, maintain financial stability, and navigate challenges. The analysis covers key financial metrics, comparative performance with peers (UBA, Fidelity, and FBNH), credit…

Ghana Explores Green Bonds for Climate-Resilient Projects

The Ghanaian government, inspired by Zambia’s renewable energy funding, is considering green bonds to finance climate-resilient projects. Ghana is actively developing projects to produce and export carbon credits, with a Carbon Market office established to manage sales. Aiming for $50 million in carbon revenue by 2024, Ghana plans to reduce over 64 million tons of CO2 equivalent by 2030, supported by global…